How to Manage Building Expenses as a Part of Revenue in a Clinic

Establishing top-notch patient care is not the only aspect of running a successful dental clinic. It is also about being aware of your figures, particularly those related to your building expenses. If not handled properly, these expenses, often known as occupation costs, can gradually reduce your cash flow.

What Are Building Expenses?

Everything you pay to maintain the physical operations of your clinic is included in building expenses. This is a breakdown of usual expenses:

1. Rent or Mortgage

This is usually the biggest building-related expense. This cost is paid in the form of a lease or a possible mortgage for a purchased building.

Rent: Usually a set amount is paid each month. It could involve annual increases. There is always the risk the lease could be ended by the landlord and a new location could be needed in a short time frame.

Mortgage: Includes principal and interest payments for any debt service for a purchased property. It may also include property taxes and property insurance.

2. Utilities

This includes gas, water, phone, electricity, and the internet. Because HVAC systems and dental equipment use a lot of energy, utility costs can be higher than residential utility fees.

Upgrades that use less energy could result in long-term savings.

3. Janitorial Services

In medical offices, cleanliness is crucial. There are waste disposal fees, and a cleaning crew will be needed frequently for hallways and bathrooms.

Depending on patient volume, some clinics prefer to do some cleaning every day, while others choose to do a deeper cleaning one or two times a week.

4. Property Taxes

The office is responsible for property taxes if the property is owned and not rented. These vary based on the office location and are often paid annually or semi-annually.

5. Insurance

If you have ownership or leasing, insurance is important. Property insurance covers liability and the physical structure of the office. Renters insurance can help cover leasehold improvements or contents.

To avoid overpaying or underinsuring, make sure that you review your policy once a year.

6. Landscaping & Maintenance

First impressions count. Maintaining the facility’s welcoming appeal and safety requires HVAC maintenance, snow removal, and landscaping.

If maintenance is ignored, it might eventually result in costly emergencies.

7. Building Improvements

Maintenance is also needed at various times to paint walls, replace carpet, change cabinets and counters. These leasehold improvements are necessary but can require a large expense at one time and inconsistent intervals. It’s important to budget ahead for these expenses to avoid surprises by unexpected expense and its impact on the budget.

Why Monitor These Costs as a % of Revenue?

This is why it’s important to check the percentages of the revenue:

Profitability: Your net income is lowered by high building expenses that aren’t supported sufficiently by the revenue. It’s important to have a building budget and stay within the budget so as not to compromise other areas of the practice that require investment.

Cash flow: If fixed costs like rent are too high it can have an impact on your capacity to hire employees or make investments in new technologies.

Benchmarking: Being aware of your spending and making sure it’s proportional to revenues helps to recognize imbalances and compare them to industry standards.

Industry Benchmarks: What’s Normal?

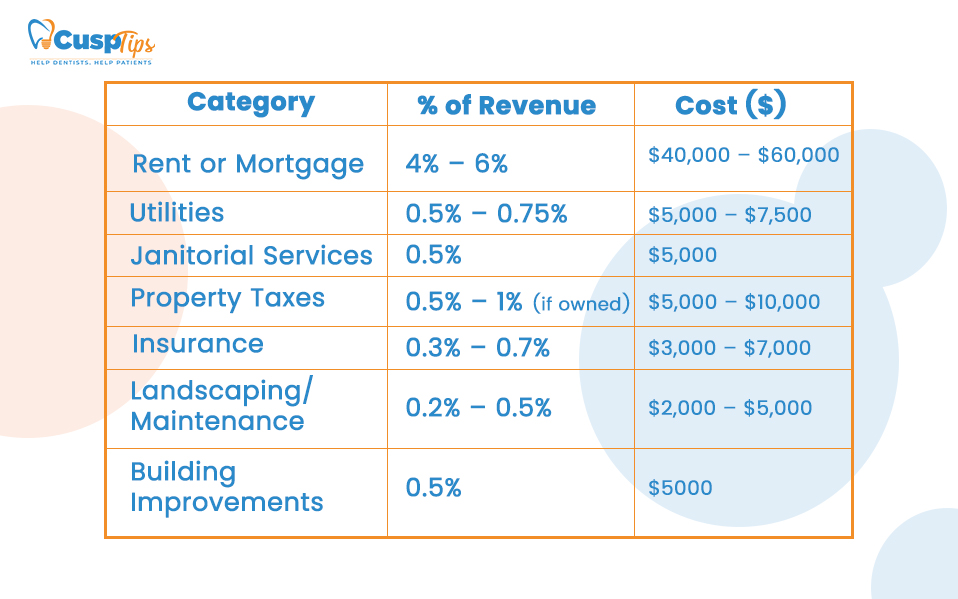

Building costs should not exceed 4% to 10% of total income for the majority of dental clinics. This is an approximate summary:

Rent or Mortgage: 4%–6% of revenue.

Utilities: 0.5%–0.75% of revenue.

Janitorial Services: 0.5% of revenue.

Property Taxes: 0.5%–1% of revenue if applicable.

Insurance: 0.3%–0.7% of revenue.

Landscaping or Grounds Maintenance: 0.2%–0.5% of revenue.

Building Improvements: Average 0.5% of revenue over last 4 years

It may be time to review your contracts, vendors, or perhaps your site if you are investing more than 10% of your income in occupancy.

Here is a sample breakdown based on a practice with $1 million annual revenue.

Smaller practices with lower revenues or practices located in more urban areas may have percentages on the higher end. Larger practices or practices located in smaller cities may have lower overhead percentages.

Building expenses may be exceptionally high over a short period of time when the work is done. Look at the budget for building improvements over longer 5 year periods.

Tips to Control Building Costs

Negotiate Lease Terms: Consider longer-term leases with fixed increases. Don’t accept boilerplate terms without review.

- Look into longer-term leases with set increases while negotiating the terms of the lease.

- Go over the Use of the Utility Plans. Plan for HVAC repairs, convert to LED lights, and turn off any unnecessary equipment, and use programmable thermostats..

- Packaged Services are good for cutting expenses. Look for providers who offer maintenance and cleaning contracts together.

- Compare different insurance policies. Sometimes switching providers can save thousands of dollars.

- Look into your monthly spending. Use accounting software to keep an eye on trends. Know your budget and plan building upgrades carefully

Final Thoughts

Your dental clinic’s building expenses may not seem like an important thing to monitor- and it can be difficult to impact since many costs are fixed- , but it directly affects your profit margin. Understanding and managing expenses as a proportion of revenue might be the difference between running a profitable business and just surviving.

Continue to stay updated. Revise often. And don’t be afraid to get professional financial advice when needed.